Last month I touched on the importance of putting aside time for healthy eating and exercise. As time is one of the biggest excuses I hear for not exercising or eating healthy, finances come in second. When it comes to spending money on services and products that will help us become healthier individuals, a lot of us find that we cannot afford this “luxury.” However, when you sit down and begin to analyze how you spend your earnings, are the items you are prioritizing going to help you live a longer more fulfilling life?

Health care has become far and away one of, if not the most expensive part of this country’s expenses, upwards of over 3 trillion annually. This will continue to rise and is expected to reach 4.8 trillion in 2021 (just 6 years from now) this will account for 1/5 the gross domestic product. In fact, the growing burden of chronic diseases adds significantly to escalating health care costs. Researchers predict a 42% increase in chronic disease cases by 2023, adding $4.2 trillion in treatment costs and lost economic output. Much of this cost is preventable, since many chronic conditions are linked to unhealthy lifestyles. For example, obesity accounts for an estimated 12% of the health spending growth in recent years.

With the condition of our country’s health, it is unfortunate that we live in a society where one is judged by the size of their house, what type of car they drive, and the clothes they wear. Let me ask you this, when you get sick, is your Porsche going to make you well again? Is that Louis Vuitton purse going to help your high blood pressure, or diabetes?

Over the cost of a person’s lifetime it’s estimated that they’ll spend $316,600 on health insurance, doctor visits, prescription drugs and other health care related expenses. Although not all of these expenses can be prevented, it is important to note that the majority of healthcare related expenses come from preventable diseases that can often times be corrected or avoided all together with healthy eating and exercise. By making preventative investments in one’s long term health such as gym memberships, personal training or group training classes, massage, acupuncture, many of these “inevitable” health care costs can be brought down substantially.

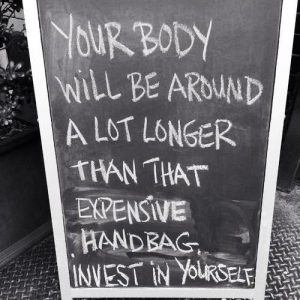

I find it troublesome when I meet someone that says they cannot afford to invest in their own health through these types of services because it’s too expensive. Yet, they have the money to afford a brand new Mercedes, designer clothes, a beautiful McMansion, and regular dinners out. When you really think about it, most of us can afford to pay for these services; it just takes sacrificing other things less important to make it happen. When it comes to budgeting, the necessities like food, shelter, and health should top the list. Everything else should fall secondary. Because at the end of the day your body is going to be around a lot longer than your expensive handbag, so invest in yourself.

Leave a Reply